One click on the “Review & Pay” button in your invoice email. We also took our expert’s view into accounting when calculating our star ratings. You can check out our comparison table to see how Wave compares against the top accountancy providers, too. Wave currently supports four web browsers; Desktop Chrome versions 65+, Desktop Firefox versions 63+, Desktop Safari versions 11.1+, and Desktop Edge versions 17+. Mobile apps are available for both iOS 11 and later as well as Android 5 and later, with both designed to be used exclusively with mobile phones.

Manage yourmoney like a boss.

Wave allows you to search transactions, design accounting reports and reconcile data across other Wave products. Plus, you can calculate sales tax automatically, customize payment terms and enjoy access to easy-to-understand cash flow insights. It also features a well-laid-out, clutter-free dashboard with individual tabs for sales, purchases, accounting, banking, payroll and reports. For instance, Wave can be used to track overdue client payments, create and send invoices and estimates, set up recurring invoices, and create payment reminders. Wave even lets businesses store client information in comprehensive customer profiles, letting users access a range of important information from one user-friendly dashboard.

Wave accounting complaints & praise (from real Wave accounting software reviews)

It’s very easy to get used to the WaveApps interface, as it is intuitive and straightforward. For example, if we compare Wave vs FreshBooks, the latter provides a four-tiered subscription schedule. For example, Bookkeeping support costs $149 per month, which can be a lot for small businesses. Wave payroll provides you with a tax service in a way – you will gain access to important tax forms and documents.

Wave Accounting pros

Most of the people who run these companies are in the business to get rick quickly and sell the company even though they sometime end up in prison for unscrupulous behavior. Bank data connections with Wave are read-only and use 256-bit encryption, and its servers are housed under physical and electronic protection. Wave is PCI Level-1 certified for handling credit card and bank account information. Multi-factor authentication is required for bank connections through Plaid, a third-party account aggregator that is a standard in the financial industry.

Scammy «upgrade», lost all my scanned invoices

They keep changing the transaction page and it is awful now. Every time they update that page it’s for the worst, not for the better. You can’t read more than two words from the description of each line item. Now you have to click https://www.business-accounting.net/turntable-repair/ on each to read the description which adds hundreds of hours of work to bookkeeping when you used to be able to see it by simply scrolling up and down. It seems you also can’t add new categories the way you used to be able to.

- However, like most products with free plans, Wave has its limitations, especially compared to more scalable small-business accounting software.

- In contrast, FreshBooks’ cheapest plan starts at $19 and limits you to billing just five clients a month.

- Deposit times may vary due to processing cutoff times or third party delays.

- You can’t pay bills through Wave as you can in Intuit QuickBooks Online, but you can record them, mark them as paid, and track the status of your payables.

- There are tables of invoices payable to you, bills you owe, and income/expense/net income.

Get support from Wave’s team of bookkeeping, accounting, and payroll experts. This feature is perfect for those who are just getting started with accounting. The best part of Wave advisors is that they are available year-round and will provide advice tailored to your business goals. In addition, Wave allows you to add an unlimited number of partners, collaborators, or accountants. This accounting software also offers integrations with popular accounting software, such as QuickBooks and Xero.

Yes, Wave Accounting is safe and secure to use for bookkeeping. The software is PCI Level-1 certified for processing bank account and credit card information. Wave’s stored bank data relies on 256-bit encryption, and Wave states that its servers are both physically and virtually secured. To review Wave, we set up a free Wave Accounting account that we used to create invoices, record sample transactions and generate financial reports. We also read verified Wave Accounting and Wave app reviews on third-party sites like Gartner, Trustpilot, the App Store, Google Play and more.

All payments are subject to a risk review and periodic credit risk assessments are done on business owners because we need to cover our butts (and yours). In some cases, we may hold funds and request more information if we need it for the protection of your business and Wave’s. With this in mind, we break down Wave’s accountancy features, from bookkeeping to financial reporting. Like all product dashboards, the Wave dashboard gives you a good overview of business performance, along with options to connect a bank account or credit card.

All feedback, positive or negative, helps us to improve the way we help small businesses. When it comes to integrations, Wave is pretty limited, although it does support a much-needed Zapier integration, which connects Wave with 1,000+ add-ons. The integrations Wave directly connects with are PayPal, Etsy, and Shoeboxed.

PCMag.com is a leading authority on technology, delivering lab-based, independent reviews of the latest products and services. Our expert industry analysis and practical solutions help you make better buying decisions and get more from technology. Wave supports double-entry accounting, which makes accountants happy. Among other things, this means that Wave has a chart of accounts and deals with debits and credits in the background so that you don’t have to.

The Wave accounting system comes with a wide range of features, such as invoicing, expense tracking, and bookkeeping. With Wave, you can also accept payments, run payroll, and get access to advisors. This takes into account customer management, revenue recognition, invoice management, and collections.

Unfortunately, Wave does not offer a project management feature. You can access personalized support through the Wave Advisor program where you can get coaching and year-round https://www.quick-bookkeeping.net/ advice from a Wave expert. These support services are expensive for most small businesses, and we can’t fully recommend them to you unless you have a budget to spare.

Our robust small business accounting reports are easy to use and show month-to-month or year-to-year comparisons so you can easily identify cash flow trends. With the Pro Plan, automatically import, merge, and categorize your bank transactions. It’s always available, and it’s backed up for extra peace of mind. Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe. Using billing software helps to eliminate some or all potential human errors by automating several processes that are normally done manually.

Wave offers a ton of features, all designed with small business owners in mind. These features include the addition of Wave Plus, a service provided by Wave that will do your monthly small business bookkeeping, provide tax services, or assign a personal coach to you. Wave offers double-entry accounting in an easy-to-use application.

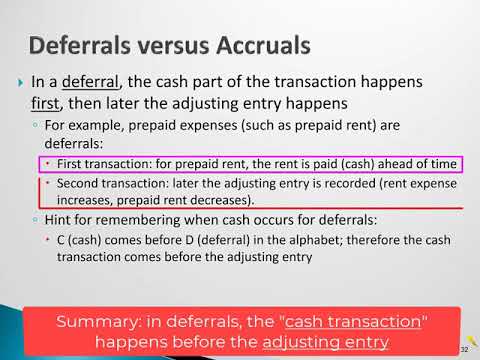

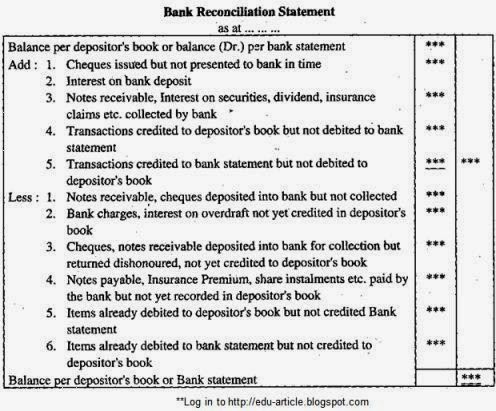

The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash. With the paid version, you can connect your bank account to Wave sales invoice and upload bank statements to synchronize your transactions. However, Wave’s reconciliation feature is not as seamless as those in other software like QuickBooks Online. For instance, while it has an automatic reconciliation feature, it doesn’t allow for any reconciling items, such as checks written but not yet processed by your bank.