With proper inventory management, you can ensure a steady supply of materials while keeping expenses under control. Advanced job costing functionalities empower you to identify areas for cost reduction, enhance productivity, and boost profitability. Let’s explore the essential features that every excellent accounting software for manufacturing should include. Costs are assigned to inventory using either a standard costing, weighted-average cost, or cost layering methodology. See the standard costing, weighted-average method, FIFO, and LIFO topics for more information.

What is a manufacturing account?

Accurate manufacturing accounting ensures businesses can confidently sail through financial uncertainties, thanks to comprehensive accounting data. It provides a detailed insight into the indirect costs and total cost of manufacturing, helping companies to evaluate their profitability. This accuracy in determining the cost of producing a product is vital for strategic decision-making and maintaining healthy inventory management practices, aligning with generally accepted accounting principles. Manufacturing accountants are like the guardians of the treasure chest, ensuring no coin is wasted, epitomizing the precision and efficiency of modern manufacturing accounting. They follow certain best practices, such as cost accounting methods focusing on manufacturing costs. This includes tracking direct costs like materials and labor and tricky indirect costs like electricity or rent, showcasing how manufacturing accounting includes accounting data on all operational expenses.

Cost Accounting

When investing in manufacturing accounting software, it’s important to find a system that contains all the features you need – and not too many that you’ll never use. If the software is too complex or too time-consuming to implement, you can end up without seeing any return on the investment. Variable costs are any production costs that change as you produce more or fewer items. For example, raw materials are typically variable because more materials are required to produce more items. To help improve and ease accounting for manufacturing, here are 5 best practices for inventory and production cost accounting methods. Utilities, clerks, security guards, cleaning supplies, rentals, insurance, recruiters, and other costs are considered overhead.

Manufacturing Accounts FAQs

To reduce the costs of doing business, you must understand first where your production costs lie. Inventory valuation is a fundamental aspect of accounting for manufacturing businesses, as it directly impacts financial statements and tax obligations. The choice of inventory valuation method can significantly influence reported earnings and inventory values, making it essential for manufacturers to select the most appropriate technique for their operations. One commonly used method is First-In, First-Out (FIFO), which assumes that the oldest inventory items are sold first.

Create a Free Account and Ask Any Financial Question

- As an accounting advisor, your opportunity through technology, is to simplify their systems and provide clarity.

- This insight is invaluable for businesses looking to maximize their profit margins while still providing a high-quality product or service for their customers.

- For example, that might include rent for your factory or interest payments on a business loan.

- A manufacturing account tracks a manufacturing business’s production costs, materials used, and inventory levels.

- The process essentially involves estimating these costs and ensuring that the company remains profitable.

- It involves calculating a standard rate for groups of costs that go into each unit, including direct materials, direct labor, and manufacturing overhead.

This approach is particularly beneficial in times of rising prices, as it results in lower cost of goods sold (COGS) and higher ending inventory values, thereby boosting reported profits. The chosen accounting method should offer detailed insights into material costs, direct and indirect labor costs, and overhead, the advantages of the direct method of cost allocation chron com enabling accurate financial reporting and decision-making. This method is by far the most common method used in manufacturing businesses to accurately estimate their costs. In standard costing, businesses assign standard costs for raw materials and labor when factoring them into inventory and production expenses.

Best Practices for Controlling Production Costs

The income statement for merchandising and manufacturing companies differs in the reporting of the cost of the merchandise (goods) available for sale and sold during the period. Manufacturing businesses must prepare a manufacturing account as part of their internal financial statements. Intuit QuickBooks is the number one accounting software for small businesses, and QuickBooks Online is an excellent entry point for manufacturers. A production cost method should be selected based on the manufacturing business as each has its benefits and drawbacks. Standard costing is an accounting system where you establish standard rates for materials or labour used in production or inventory costing.

This software can be used to extract data and analyze trends, improve efficiency, and make the best business decisions. This inventory valuation method operates under the assumption that the final product added to a company’s inventory is the first one sold. Job costing, also known as variable costing, is better if you manufacture to order or focus on a small amount of units. For example, this could include a custom-built machine or a small batch of products.

Direct labor costs typically include wages paid for regular hours, overtime and payroll tax information. The chart of accounts is a record of the valid accounts you assign to the business units within your company’s reporting structure. When you set up your chart of accounts, you define the location of the accounts using automatic accounting instructions (AAIs) that indicate which number ranges represent assets, liabilities, and so on. The system underlines LOD 3 on balance sheet reports and LODs 3 and 4 on income statement reports. This information helps companies arrive at better decisions about when to buy materials and sell products. Moreover, it is dubbed a complete business because it buys the raw materials used to create a product before selling it.

It is sometimes difficult to manage, however, as individual tracking and allocation of costs can be time-consuming. Fortunately, you don’t necessarily have to hire an accountant full-time for your manufacturing business at first. Outsourced accounting from a CPA firm is less expensive and may be enough to meet your needs. Manufacturing accounting is a complex process that requires specialized knowledge and skills.

It is a tool that companies can use to help manage the finances and inventory of a manufacturing company. Variable costs change depending on the number of units your manufacturing firm produces. A direct cost is an expense that you can easily trace to product manufacturing processes. ABC systems involve sorting your business’s indirect costs into groups, calculating a per-unit rate based on their primary cost drivers, then using that rate to allocate costs to products or activities.

For manufacturers, this statement helps in identifying areas where cost efficiencies can be improved. Efficient cost management in manufacturing is like having a well-oiled machine; it keeps everything running smoothly and ensures enough money in the bank to keep the lights on and machines running. By following generally accepted accounting principles (GAAP) and using the right software for manufacturing, businesses can keep a close eye on their cash flow.

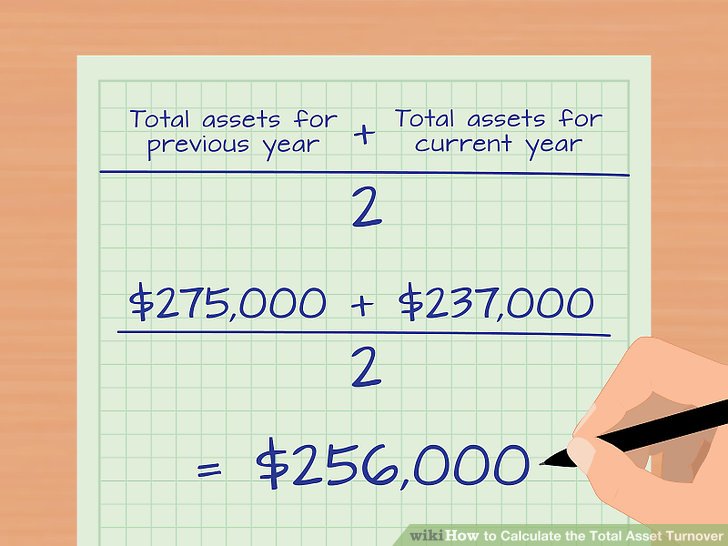

For publicly traded companies, compliance with standards such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) is mandatory. These standards provide a framework for consistent and accurate financial reporting, enabling stakeholders https://www.kelleysbookkeeping.com/what-is-an-average-ledger/ to make informed decisions. Return on assets (ROA) is another critical metric that assesses how effectively a company utilizes its assets to generate profits. For manufacturers, this involves evaluating the efficiency of machinery, equipment, and inventory management.

C This is actual manufacturing overhead for the period and includes indirect materials, indirect labor, factory rent, factory utilities, and other factory-related expenses for the month. In Chapter 2, we look at an alternative approach to recording manufacturing overhead called normal costing. The job costing method is used to assign a unique cost to each production run or batch of products. It takes into account the labor, materials, and overhead required for each individual job. There are complex manufacturing costs and operations, inventory valuation and management, and detailed data tracking on an individual product, job, and production basis. The best manufacturing accounting software uses automation to ensure accurately recorded costs throughout the year, reduce admin time, and minimise the risk of human error.

Manufacturing accounting systems offer valuable visibility into key aspects of inventory management, encompassing goods acquisition, stock valuation, and the calculation of moving average costs (MAC). These insights enable businesses to optimize their inventory management strategies and achieve a more streamlined and profitable manufacturing process. This is a costing method that differs from job costing in that it incorporates more indirect costs, such as resource consumption.

By maintaining robust financial reporting practices, manufacturers can build trust with stakeholders, attract investment, and support long-term growth. One key aspect of lean accounting is value stream costing, which tracks costs along https://www.accountingcoaching.online/ the entire value stream rather than individual departments or processes. This holistic approach helps manufacturers identify and eliminate non-value-added activities, thereby improving cost efficiency and operational performance.